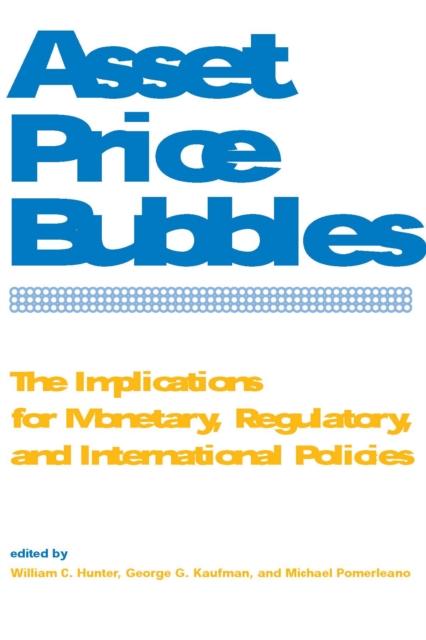

Asset Price Bubbles : The Implications for Monetary, Regulatory, and International Policies PDF

Edited by William C. Hunter, George G. Kaufman, Michael Pomerleano

Part of the The MIT Press series

Description

In both the industrialized and developing worlds, a distinctive feature of the last two decades has been prolonged buildups and sharp collapses in asset markets such as stock, housing, and exchange markets. The volatility has sparked intense debate in academic and policy circles over the appropriate monetary and regulatory response to dramatic market shifts. This book examines asset price bubbles to further our understanding of the causes and implications of financial instability, focusing on the potential of central banks and regulatory agencies to prevent it. The book grew out of a conference jointly sponsored by the Federal Reserve Bank of Chicago and the World Bank Group in April 2002.

Information

-

Download - Immediately Available

- Format:PDF

- Pages:607 pages

- Publisher:The MIT Press

- Publication Date:14/01/2005

- Category:

- ISBN:9780262275910

Information

-

Download - Immediately Available

- Format:PDF

- Pages:607 pages

- Publisher:The MIT Press

- Publication Date:14/01/2005

- Category:

- ISBN:9780262275910